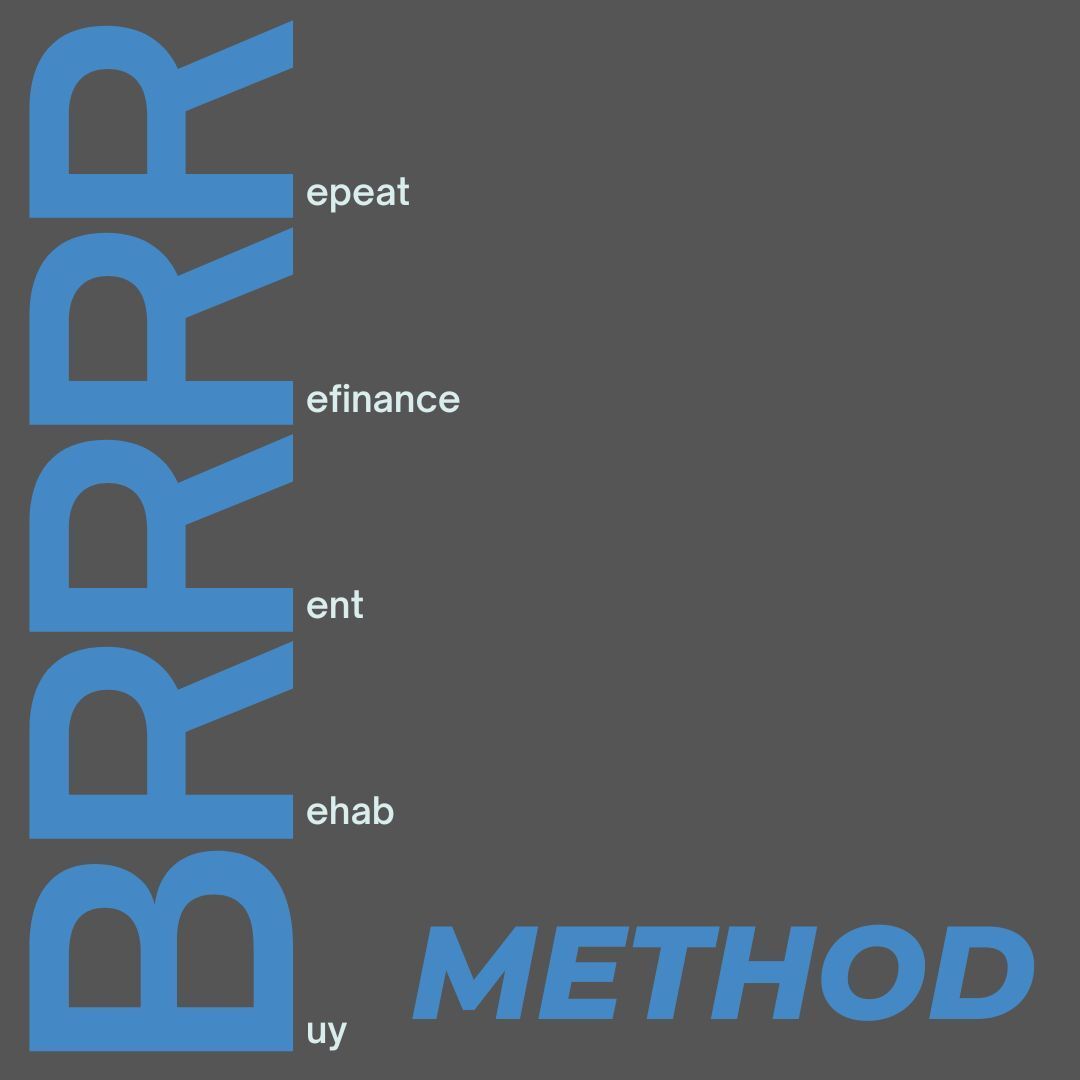

BRRRR Method

Many investors have used the BRRRR strategy to quickly build their real estate business.

BRRRR stands for buy, rehab, rent, refinance, repeat. This strategy allows investors to purchase distressed properties and keep them as rental properties rather than selling them. This is a great way to earn passive income.

The BRRRR strategy is a great way to quickly build your real estate business. With this strategy, you buy a distressed property, rehab it, and then rent it out instead of selling it. This allows you to earn passive income and build equity over time.

To use the BRRRR strategy, you will need to get short-term financing to purchase the property. This could be in the form of hard money, a home equity loan, private money, or cash. Once purchased, you can rehab the property. When it is finished, you can rent it out and then refinance the loan to pay off the short-term loan. This will turn the property into a stable, long-term investment that will continue to generate cash flow and equity for you. And then, you can repeat the process with a new property.